Un número gratuito

Empieza a llamar: las funciones esenciales son gratuitas, el plan Pro cuesta 19€.

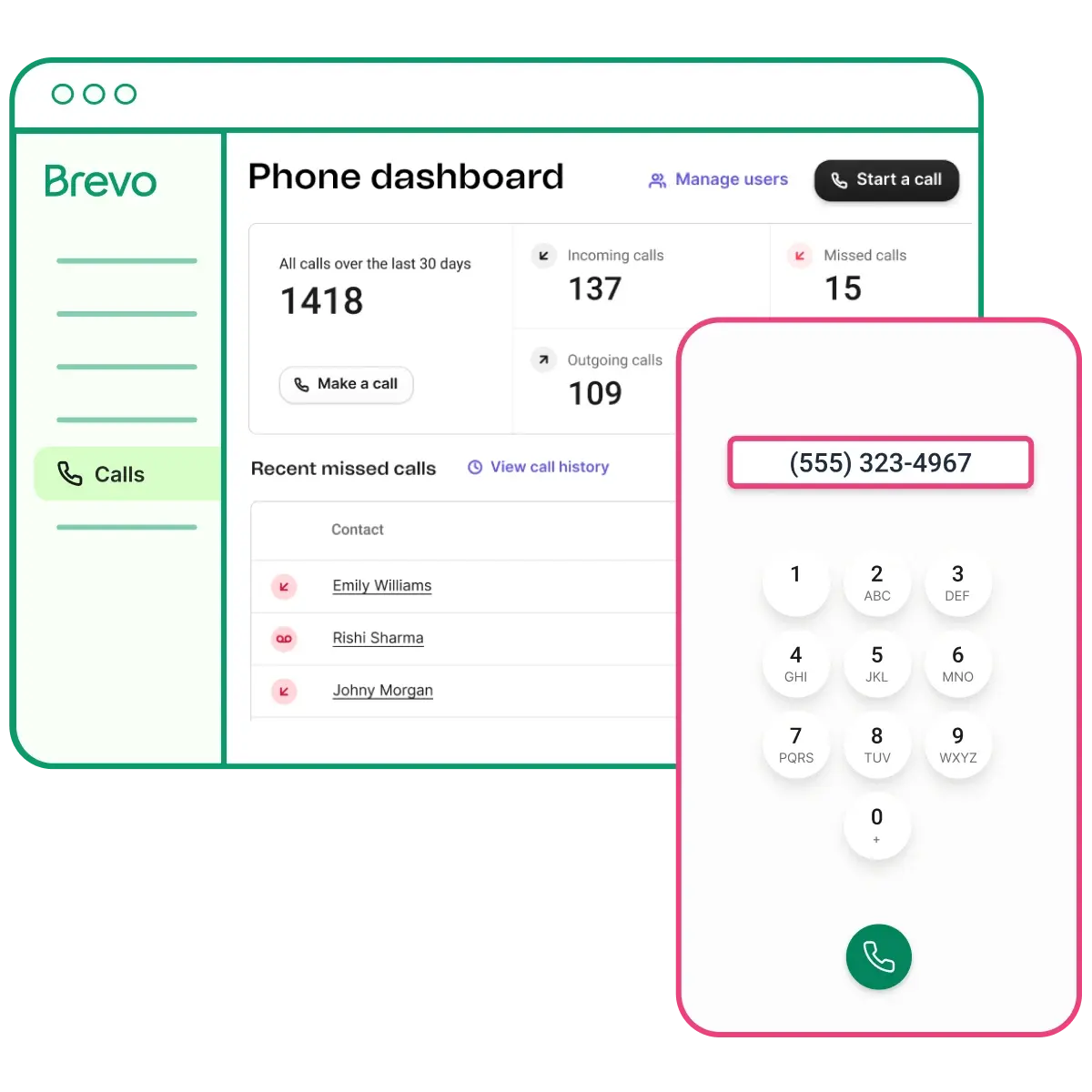

Una herramienta para todo

Encuentra tus contactos, historial de llamadas y grabaciones en Brevo.

Llama en todo el mundo

Haz y recibe llamadas de trabajo con la interfaz de llamadas web o la app.

Prueba Phone gratis

Crea tu cuenta gratis, sin tarjeta de crédito.Explora nuestros productos

Marketing Platform

Funcionalidades principales:

- Email marketing

- Automatización de marketing

- Campañas de SMS y WhatsApp

Sales Platform

Funcionalidades principales:

- Gestión de pipeline de ventas

- Seguimiento automatizado de oportunidades

- Reuniones y grabación de llamadas

Messaging API

Funcionalidades principales:

- API de email, SMS y WhatsApp

- Integración CMS

- Inbound parsing