Vende más con mensajes dirigidos a tus clientes

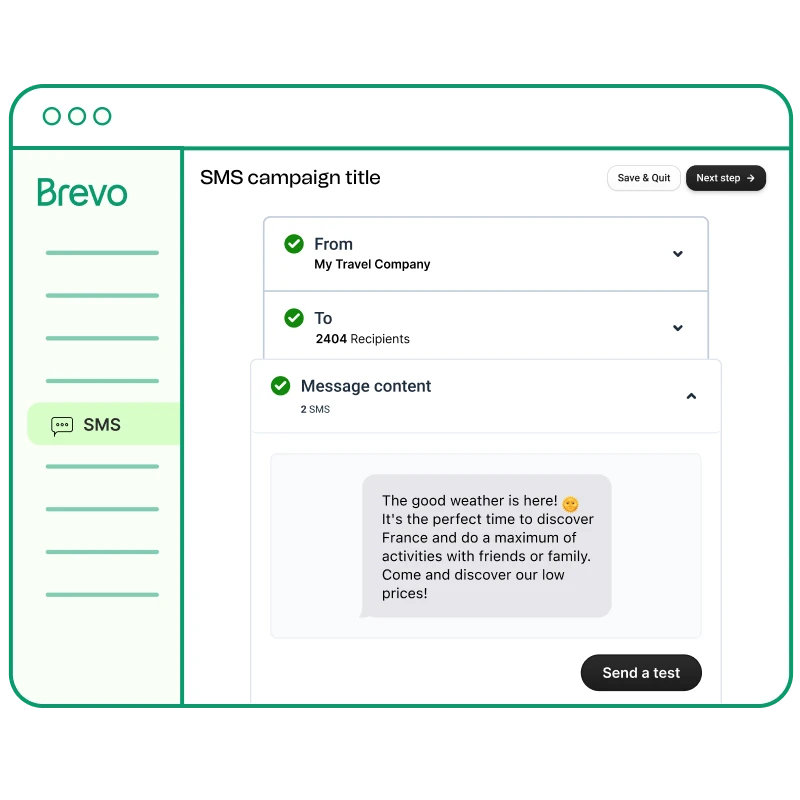

Promociona tu marca con campañas de SMS enviadas directamente a tus clientes.

Envía notificaciones y gana más engagement

Activa SMS transaccionales para alertas automáticas, como confirmaciones de pedidos.

Crea campañas de SMS marketing inteligentes

Perfecciona tu estrategia de SMS. Utiliza los datos de campañas y mira qué interesa a tu público.

¿Todo listo para empezar?

Lánzate al SMS marketing con créditos SMS de prepago que nunca caducan. Con Brevo, solo pagas lo que usas.Explora otros productos

Sales Platform

Funcionalidades principales

- Gestión de pipeline de ventas

- Seguimiento automatizado de oportunidades

- Reuniones y grabación de llamadas

Conversations Platform

Funcionalidades principales

- Chat

- Phone

- Inbox universal

Messaging API

Funcionalidades principales

- API de email, SMS y WhatsApp

- Integración CMS

- Inbound parsing