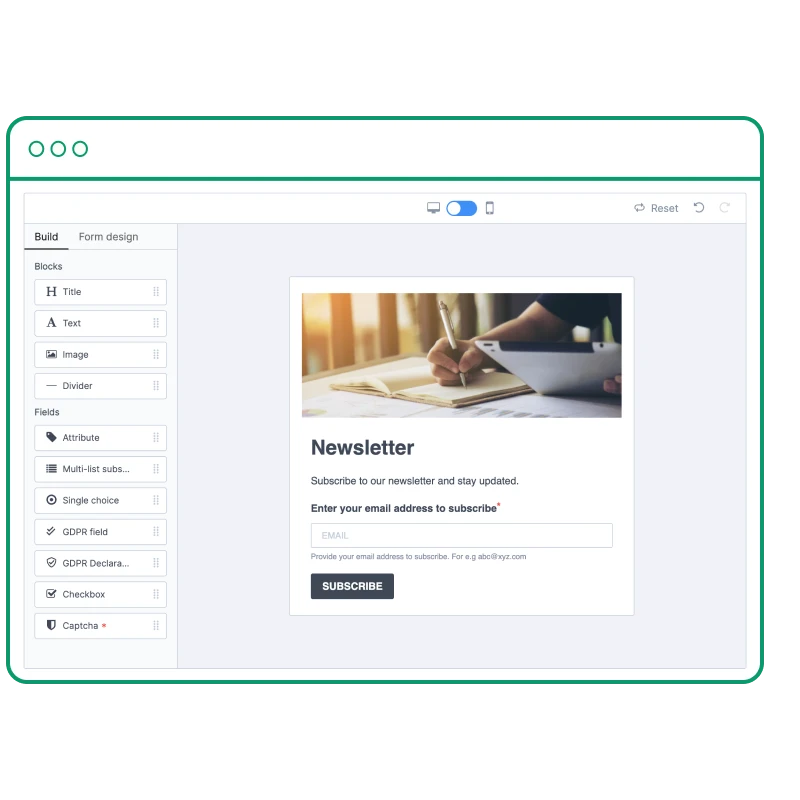

Crea formularios de registro únicos

Adapta tu marca a tus formularios con un editor intuitivo, y crear formularios sencillos.

Obtén los datos que necesitas

Elige entre varios campos para recopilar la información que desees de tus contactos.

Atrae suscriptores en varios canales

Añade un formulario a tu web, compártelo en redes sociales o incluye un link en tus emails.

Crea una cuenta gratuita

Crea formularios de suscripción y aumenta tu lista de emails en pocos clics. Prueba gratis las herramientas de marketing.Explora otros productos

Sales Platform

Funcionalidades principales

- Gestión de pipeline de ventas

- Seguimiento automatizado de oportunidades

- Reuniones y grabación de llamadas

Conversations Platform

Funcionalidades principales

- Chat

- Phone

- Inbox universal

Messaging API

Funcionalidades principales

- API de email, SMS y WhatsApp

- Integración CMS

- Inbound parsing