VISIÓN 360 DEL CLIENTE

Afina tu estrategia con una visión 360

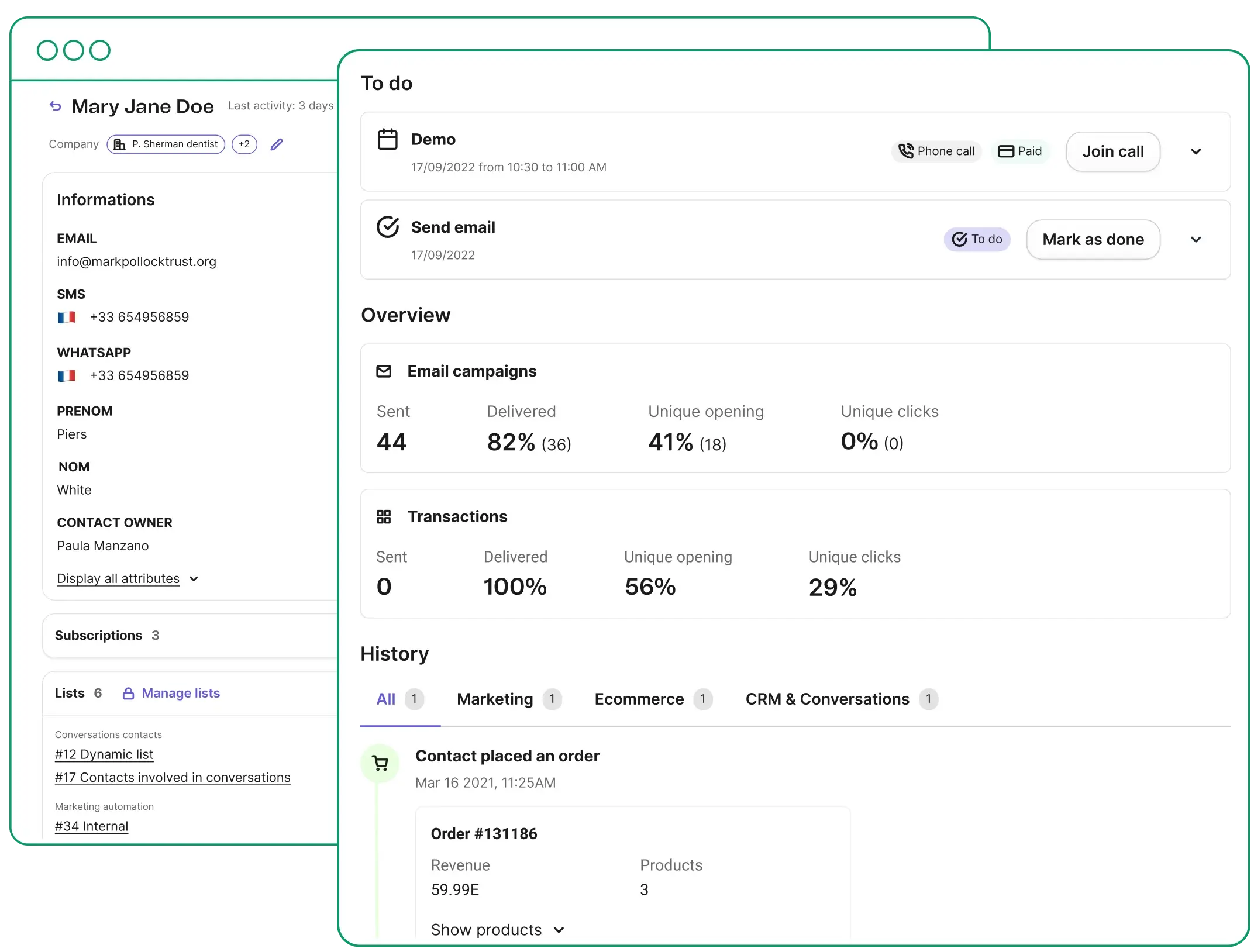

Obtén una visión integral

Mira los puntos de contacto con el cliente en todos los canales de comunicación.

Una solución colaborativa

Potencia la colaboración entre marketing y ventas con un perfil de cliente unificado.

Historial completo

Impulsa conversaciones significativas con un historial de interacciones actualizado.

Crea tu cuenta gratuita

Disfruta de contactos ilimitadosExplora otros productos

Marketing Platform

Funcionalidades principales

- Email marketing

- Automatización de marketing

- Campañas de SMS y WhatsApp

Sales Platform

Funcionalidades principales

- Gestión de pipeline de ventas

- Seguimiento automatizado de oportunidades

- Reuniones y grabación de llamadas

Conversations Platform

Funcionalidades principales

- Chat

- Phone

- Inbox universal