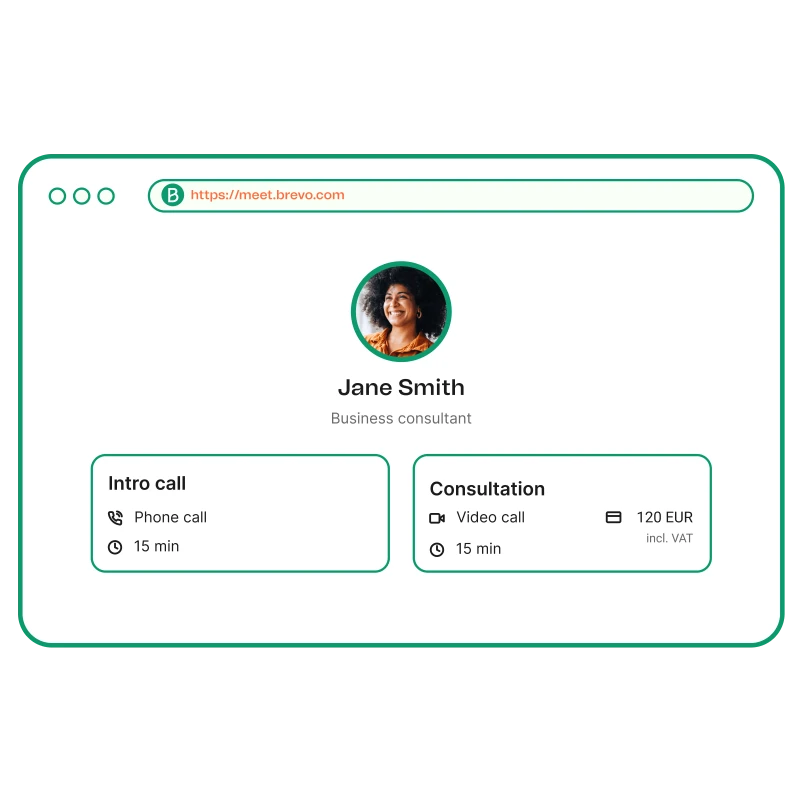

Agenda tus reuniones fácilmente y al instante

Facilita la programación de reuniones con clientes, gracias a páginas de reserva personalizadas.

Elige la plataforma de videollamadas para tu reunión

Elige la solución de videollamadas de Brevo o integra Zoom, Google Meet u otros proveedores.

Deja que tus clientes decidan cuándo reunirse contigo

Usa un enlace para que tus clientes reserven reuniones cuando están muy interesados.

Crea tu cuenta gratuita

Pruebe Brevo Meetings gratis, sin tarjeta bancaria.Explora nuestros productos

Marketing Platform

Funcionalidades principales:

- Email marketing

- Automatización de marketing

- Campañas de SMS y WhatsApp

Conversations Platform

Funcionalidades principales:

- Chat

- Phone

- Inbox universal

Messaging API

Funcionalidades principales:

- API de email, SMS y WhatsApp

- Integración CMS

- Inbound parsing